The first annual of ESAs reporting – What you need to know

Recently, The European Supervisory Authorities (ESAs) consisting of ESMA, EBA and EIOPA, published their first annual report on the extent

The Sustainable Finance Disclosure Regulation (SFDR) may give you some headaches, but also brings a lot of opportunities. Ensure a smooth road to compliance for all reporting obligations by using BIQHs comprehensive SFDR Data Solution.

With the BIQH Market Data Platform for SFDR you will have complete insight in your SFDR data coverage. Instead of taking in multiple data feeds from many data vendors yourself, you will have access to all SFDR data points via a consolidated API. This includes the results for indicators that require complex calculations.

SFDR Data Coverage

The road to SFDR compliance starts with the selection of your data vendors who will deliver the required data. BIQH is connected to numerous data vendors such as Sustainalytics, MSCI, and Morningstar and is ready to help you performing data coverage checks. By using the consolidated BIQH data model, you are completely free to choose whatever data source you like. As a result, you remain to be flexible in data sourcing when – for instance – data quality is not up to par with your requirements.

Availability of SFDR data

The BIQH Market Data Platform enables her clients to use one consolidated API to retrieve all required data for SFDR reporting requirements, saving them a lot of time and money in maintaining the high amount of data fields required. Our API is feeding all your systems, applications, and documents that you are providing to your end users and regulators. By using the GraphQL API, you are completely free to configure the data delivery formats in any way you want. A switch of data sources causes no IT impact, making it to change the solution or cope with new and/or changes regulatory requirements.

SFDR calculations as a service

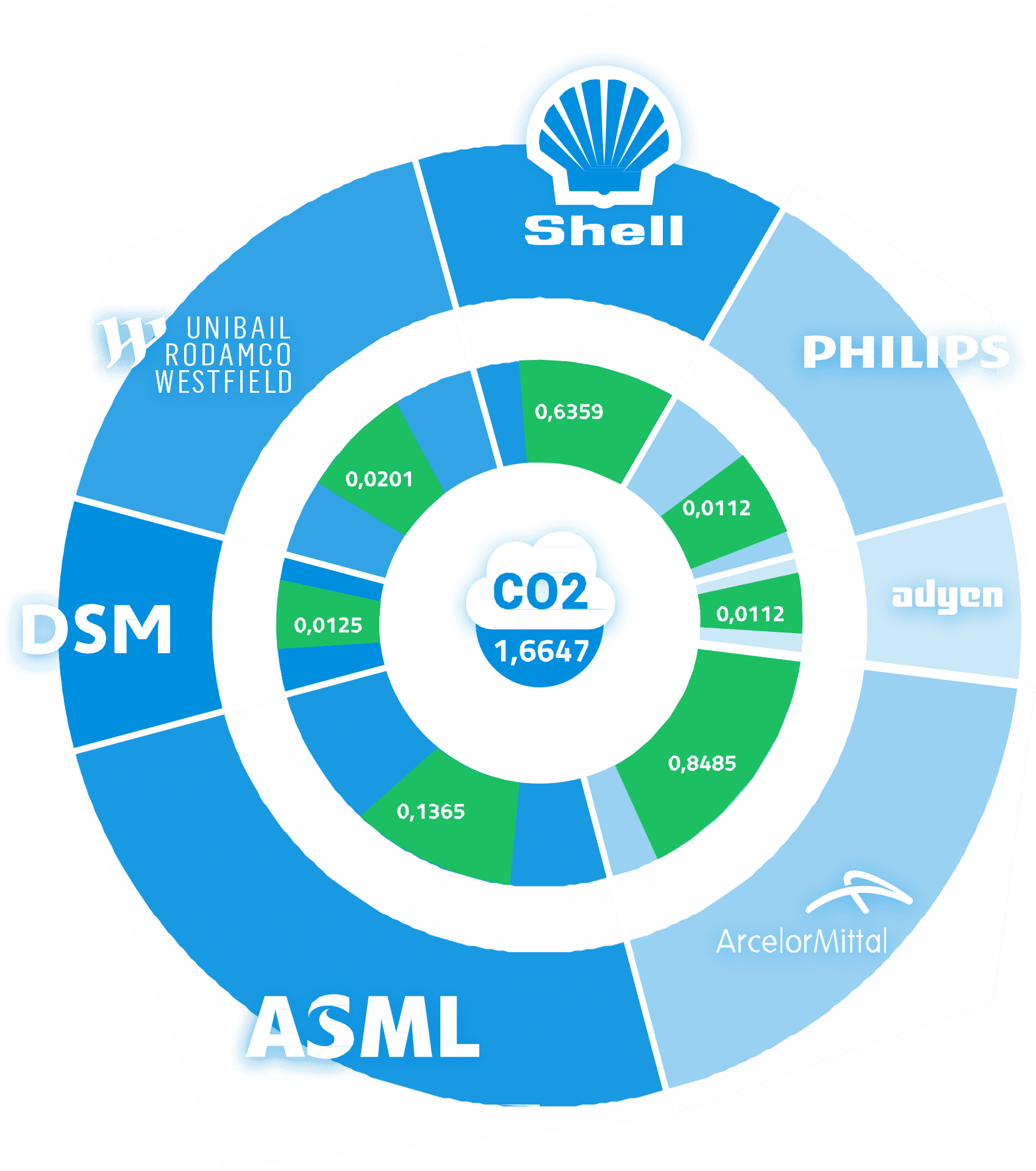

Processing the data feeds from multiple data vendors is one part, performing calculations is another. For example, we help you calculating the ‘carbon footprint’ of your managed portfolios. Or, we help you to calculate the principal adverse impact (PAI) indicators. The BIQH Market Data Platform and our managed services takes care of all these complex calculations. Naturally, calculated values and/or derived data are stored in the BIQH cloud and become available in the BIQH API distribution layer for your data analytics purposes. Finally, we provide you with the means to track and trace the outcomes of the calculations back to the origins of the raw data being delivered by your desired data sources.

Our ESG screening integrates data from internal and external sources to evaluate each company's sustainability practices. This results in a structured and mapped integration of all unrelated data, ensuring financial institutions have accurate and actionable information for investment decisions.

We offer customizable business rules that allow financial institutions to tailor the ESG evaluation to their specific needs and priorities. This flexibility ensures that the screening process aligns with their unique investment strategies and goals.

Our service enables financial institutions to apply ESG screening to externally managed investment portfolios, such as mutual funds and ETFs. This helps mitigate risks in the supply chain and ensures that all partners meet high ESG standards.

Interested? Want more information, see more of the Market Data Platform, or have an online coffee chat?

Get in touch!

Recently, The European Supervisory Authorities (ESAs) consisting of ESMA, EBA and EIOPA, published their first annual report on the extent

The final SFDR RTS has been adopted by the European Commission. In this article we briefly summarize the changes per

![Sustainable Finance Disclosure Regulation [SFDR]: The interaction with the upcoming Corporate Sustainability Reporting Directive [CSRD]](https://www.biqh.com/wp-content/uploads/2021/08/shutterstock_772691686-768x513.jpg)

In this blog post we would like to inform you on recent developments of company reporting requirements on non-financial data

Financial Market Participants have to overcome multiple challenges to comply to SFDR. In this blog post we tell you what

In this blog post we will talk you through all the steps that have to be taken to be fully

In this article we will focus on the indicators and associated metrics, which are part of the Adverse Sustainability Impacts

![Sustainable Finance Disclosure Regulation [SFDR]: The Adverse Sustainability Impacts Statement](https://www.biqh.com/wp-content/uploads/2020/11/shutterstock_1110854234-1-768x512.jpg)

In this article we will focus on the Adverse Sustainability Impacts Statement and its implications for Financial Market Participants [FMPs].

![Sustainable Finance Disclosure Regulation [SFDR]: Timelines and progress of implementation](https://www.biqh.com/wp-content/uploads/2020/11/pexels-scott-webb-305833-768x512.jpg)

When to expect or do what? In this article we listed all the important dates for the new Sustainable Finance

The new Sustainable Finance Disclosure Regulation will have big impact on asset managers, banks and fund brokers. What to expect?

In this blog post we offer you the most complete SFDR glossary; giving you a complete overview of all important

Now with the final Regulatory Technical Standards (RTS) available it is time to give you an SFDR update; what has

Recently the European Commission announced the delay of the Regulatory Technical Standards [RTS] of SFDR. But does this mean the

BIQH provides market data management in the cloud. We have won multiple prestigious awards! Discover more about our Best Use of Agile Methodology, ESG Insight Awards 2024 and our Best customer service in European data management victories.

Visit our corporate website: ShareCompany

By visiting this website you agree to the use of cookies and our privacy policy

Gain valuable insights into easily switching data vendors and explore our real-world use cases.

10 July 2025 · 15:00 CEST