As of March 2021 the new Sustainable Finance Disclosure Regulation [SFDR] came into effect. This regulation is developed to drive sustainable investment. The SFDR will have big impact on asset managers, banks and fund brokers. We offer you a complete blog series focusing on the SFDR, the obligations, the timelines, the definitions, the indicators and the Adverse Sustainability Impacts Statement to help you get your head around the subject. In our blog posts we focus on the impact of this regulation to you as a Financial Market Participant to ensure you are well prepared for the new regulation.

In this blog post we will focus on common market data challenges we usually solve for our customers and discuss why these are even more challenging for SFDR. We also give some practical advice on how to overcome these challenges.

This blog post was first published on January 7, 2021 and updated on August 25, 2021.

Common SFDR market data challenges

Financial Market Participants have to overcome multiple challenges to comply to SFDR. Most of these challenges will sound similar to the regular market data changes a FMP has to overcome every day. But keep in mind that SFDR requires extra effort, because it mostly requires non-financial data from multiple sources. On top of that, getting this data into your network is no walk in the park because availability is not widespread yet.

1. SFDR requires data from multiple sources and multiple vendors

The ESAs published their final report on the draft Regulatory Technical Standards [RTS] in February 2021. Based on these RTS we assume that SFDR requires data from multiple sources and multiple vendors. adding a lot of complexity to the game.

Short after the publication of the ESAs’ joint consultation paper in April 2020 we have sent out a request for information (RFI) to the biggest market data vendors. We asked them about their data coverage on Adverse Sustainability Impact attributes, (calculated) metrics and their instrument universe. Not all of them provided the necessary information, but none of them is likely to provide 100% of the required data. Based on the outcomes of this RFI we expect you will at least need to contract two, but more likely three different providers. In addition, it is expected that data from fund accounting and portfolio management systems need to be sourced to combine these data with data provided from external sources in order to calculate the metrics to be able to comply with SFDR.

Next to the contracting part, the number of data sources also affects the IT capacity needed. You will need to write and maintain multiple feed handlers to source the necessary data into your system, requiring extra capacity of your IT / data management team. Also keep in mind that most of the obligations under SFDR will require you to disclose information in multiple languages. Another technical challenge is to address the changes data providers make to their APIs, files and feeds. Maintenance capacity will be required to keep up with regular and incidental changes. Taking into account the necessity for multiple data vendors under SFDR, the capacity aspect should be considered carefully.

2. Data feeds are often incomplete

After closing the contract and sourcing the data there is often a new challenge popping up. When mapping the fields in the database there is always something missing. Also the actual sourced data could differ from the data in the initial sample file. When this occurs you will need to find other sources offering the missing data and write new feed handlers to take in the data. Because you cannot predict what data will be missing from the feed, this will for sure add pressure to the already strict SFDR timelines.

3. SFDR requires a lot of non-financial data

Not only smart decisions on what providers to contract are required, but you will also need to focus on the type of data that is required. To comply with the required Adverse Sustainability Impacts Statement, you might have to look further than the offerings of your current market data provider(s). SFDR contains many indicators that require non-financial data, more specifically ESG data. For example to calculate the Carbon Footprint Indicator you will need market capitalization data, holding data and carbon footprint data for that holding. Not every market data vendor will be able to offer those specific ESG fields when the SFDR becomes effective.

4. Non-financial data is not widely available for small caps

When we mention that not every market data vendor will be able to offer all the required ESG data, it is good to add that ESG data currently is commonly available for ‘Blue Chip’ companies only. For small caps this is less likely. Partially this is caused by the fact that the Non Financial Reporting Directive [NFRD], which requires large corporates to report on non-financial matters like ESG, does not apply to most small caps. The recently published, but still pending Corporate Sustainability Reporting Directive [CSRD] will partially mitigate this problem. But it still takes years before ESG data for smaller companies becomes widespread and easily accessible. This implies for instance that UCITS management companies that offer a small cap fund will need to go great lengths in order to gather the required SFDR data.

5. SFDR requires you to give insights in your data collection process

A lot of attention in the SFDR goes out to the Adverse Sustainability Impacts Statement. But there are other points that require your attention as well. For example the requirement that demands insight in your data collections process. That means you will need to report on the measurements you have taken to ensure the best possible coverage. Not only will you need to be able to provide information on your SFDR reporting sources, but you will need to ensure that data from multiple sources is equal and comparable. For example when you switch between vendors to calculate a specific metric, you will need to explain differences in field names and descriptions.

How to overcome the SFDR market data challenges

Luckily it is not all bad news. There are ways to overcome these challenges. It all starts with your data model. SFDR will test the flexibility of this model. The more flexible, the better you will be able to add or switch between market data providers and to handle multiple types of data.

Characteristics of the ideal SFDR data model

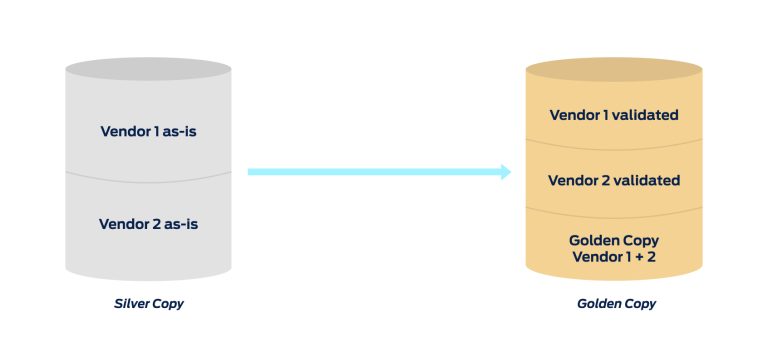

Zooming in on the ideal SFDR data model we see a few main characteristics. At the core of our believes is the single database that stores data from every provider separately. This helps you to source large amounts of data from multiple sources quickly. It also helps to easily recognize what data is missing and to fill in the gaps with data from other vendors that are already available in the database.

The ideal SFDR data model allows you to store the original data as well as the outcomes of calculations. In that way the database contains the original fields that are used to do the calculations, so you can always track the original source. The calculation output will be listed as sourced from a separate vendor (this could be you).

Finally, BIQH encourages you to study the requirements under SFDR regarding the disclosures on the data collection process. A good data model explains where the data is coming from, how it is processed and shows what actions you have taken to ensure the best possible coverage.

We are always open for a chat and we encourage discussions, especially when it comes to financial market data. Let us know your challenges, questions and uncertainties relating to the Sustainable Finance Disclosure Regulation.