The challenge of physical risks: how it forms an important aspect of ESG data

At BIQH, we regularly write about ESG data, management, and screening. This topic is crucial to us and our clients.

Tackle ESG market data challenges with practical tools and strategies designed to simplify processes and meet your goals. Explore our resources and blog articles below

Join us for a 45-minute deep dive into ESG data management on Thursday, January 30th

Webinar Highlights:

In this whitepaper, explore the essentials of ESG Screening and discover how it can make your processes faster and error-free.

After reading this factsheet you will know the easiest way to centralize scattered ESG data sources to a single data model, adapt your ESG screening requirements easily, and to govern ESG data in your target operating model.

Watch our presentation about ESG Screening at DKF Munich 2024. In this video, we will address the following topics:

After wachting this video you will know how BIQH is dealing with:

At BIQH, we regularly write about ESG data, management, and screening. This topic is crucial to us and our clients.

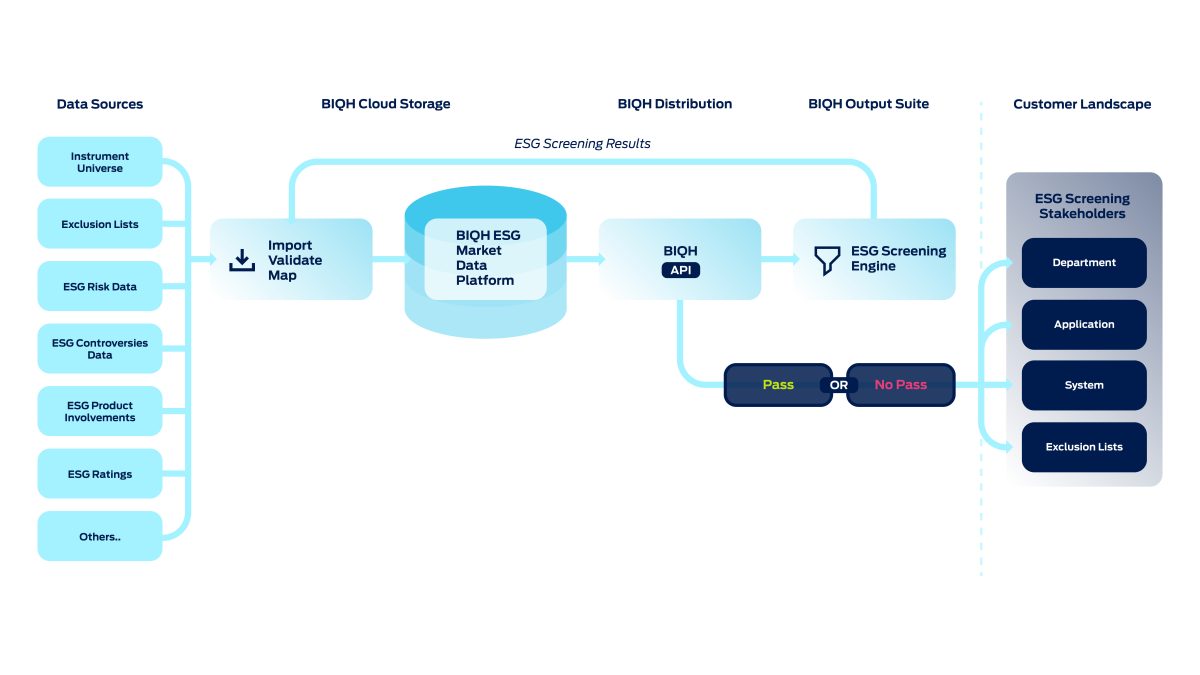

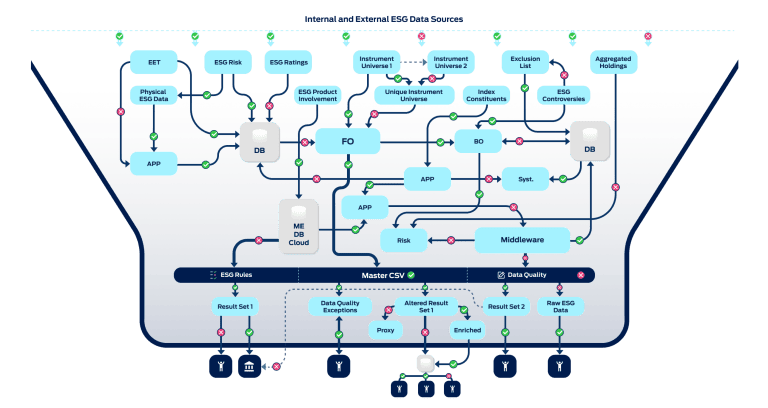

Introduction At BIQH, we often see financial institutions struggling with their ESG screening process. These institutions face challenges ranging from

Introduction Environmental, Social, and Governance (ESG) Screening is becoming increasingly important in the financial industry. Where financial institutions previously managed

Dealing with the complex landscape of Environmental, Social, and Governance (ESG) criteria can be a significant challenge for financial institutions.

In the financial world, the significance of Environmental, Social, and Governance (ESG) data is rapidly increasing, impacting both regulatory compliance

Rising to the Challenge: The Increasing Importance of ESG Data As we venture deeper into 2024, the financial world is

In an era where sustainable investing and corporate social responsibility have surged to the forefront, the quality of ESG (Environmental,

Banks and asset managers have embraced environmental, social, and governance (ESG) investments more recently. ESG screening reassures these organizations that

Recently, The European Supervisory Authorities (ESAs) consisting of ESMA, EBA and EIOPA, published their first annual report on the extent

The final SFDR RTS has been adopted by the European Commission. In this article we briefly summarize the changes per

![Sustainable Finance Disclosure Regulation [SFDR]: The interaction with the upcoming Corporate Sustainability Reporting Directive [CSRD]](https://www.biqh.com/wp-content/uploads/2021/08/shutterstock_772691686-768x513.jpg)

In this blog post we would like to inform you on recent developments of company reporting requirements on non-financial data

Financial Market Participants have to overcome multiple challenges to comply to SFDR. In this blog post we tell you what

In this blog post we will talk you through all the steps that have to be taken to be fully

In this article we will focus on the indicators and associated metrics, which are part of the Adverse Sustainability Impacts

![Sustainable Finance Disclosure Regulation [SFDR]: The Adverse Sustainability Impacts Statement](https://www.biqh.com/wp-content/uploads/2020/11/shutterstock_1110854234-1-768x512.jpg)

In this article we will focus on the Adverse Sustainability Impacts Statement and its implications for Financial Market Participants [FMPs].

![Sustainable Finance Disclosure Regulation [SFDR]: Timelines and progress of implementation](https://www.biqh.com/wp-content/uploads/2020/11/pexels-scott-webb-305833-768x512.jpg)

When to expect or do what? In this article we listed all the important dates for the new Sustainable Finance

The new Sustainable Finance Disclosure Regulation will have big impact on asset managers, banks and fund brokers. What to expect?

In this blog post we offer you the most complete SFDR glossary; giving you a complete overview of all important

Now with the final Regulatory Technical Standards (RTS) available it is time to give you an SFDR update; what has

Recently the European Commission announced the delay of the Regulatory Technical Standards [RTS] of SFDR. But does this mean the

BIQH provides market data management in the cloud. We have won multiple prestigious awards! Discover more about our Best Use of Agile Methodology, ESG Insight Awards 2024 and our Best customer service in European data management victories.

Visit our corporate website: ShareCompany

By visiting this website you agree to the use of cookies and our privacy policy