Sustainable Finance Disclosure Regulation: the road to SFDR compliance

As of March 2021 the new Sustainable Finance Disclosure Regulation [SFDR] came into effect. This regulation is developed to drive sustainable investment. The SFDR will have big impact on asset managers, banks and fund brokers. We offer you a complete blog series focusing on the SFDR, the obligations, the timelines, the definitions, the indicators and the Adverse Sustainability Impacts Statement to help you get your head around the subject. In our blog posts we focus on the impact of this regulation to you as a Financial Market Participant to ensure you are well prepared for the new regulation.

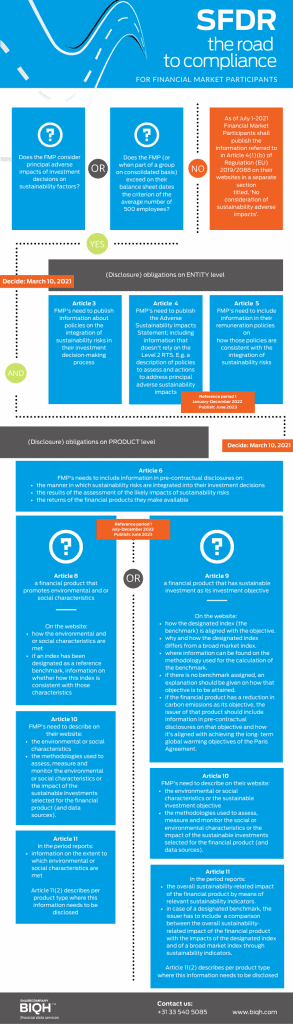

In this blog post we will talk you through all the steps that have to be taken to be fully compliant before the first reference period ends. To make it easy for you we created a comprehensive infographic. This will provide Financial Market Participants [FMPs] an overview of all requirements and steps to take in the upcoming months. We hope this will help you to get your priorities straight.

This blog post was first published on February 16, 2021 and updated on August 25, 2021.

The road to SFDR compliance: important dates

March 10, 2021: SFDR effective date; requires all level 1 obligations to be in place

July 1, 2022: First reference period starts (was 1 January 2022, but has been delayed)

January 1, 2023: Second reference period starts

June 30, 2023: The final date on which FMPs need to report for the first time

June 30, 2024: The final date by which FMPs need to report for the second time. This report should also include a comparison between the first two reference periods.

The road to SFDR compliance for Financial Market Participants

Financial Market Participants have to make many decisions on their road to comply with SFDR. As many stakeholders in the company are involved in this process, the road to SFDR compliance is complex and full of challenges. Even before starting the data collection for the Adverse Sustainability Impacts Statement, many things should be considered.

As shown in the infographic, the obligation to publish the Principal Adverse Impact [PAI] indicators starts with the following questions:

- ‘Does the FMP consider principal adverse impacts of investment decisions on sustainability factors?’; or

- ‘Does the FMP exceed the criterion of having an average number of 500 employees?’

If one of the answers is YES, then the disclosure obligations on entity and product level apply. If the answer to both questions is NO, then the FMP is required to publish a ‘statement of no consideration of sustainability adverse impacts’ on their websites.

Disclosure obligations for FMPs on entity level

When concluded that the FMP is held to disclose a PAI statement on entity level, it needs to keep three obligations in mind that are stated in article 3, 4 and 5 SFDR. They are all due on March 10, 2021, except for the indicators (article 4) related to level 2 RTS. The first reference period of the Level 2 obligations (the PAI Statement itself) starts on January 1, 2022.

Disclosure obligations for FMPs on product level

On product level a FMP needs to answer another important question.

‘Does your investment product matches the article 8 or article 9 characteristics?’

All textual disclosure obligations on product level are required as of March 10, 2021 (article 6, 8, 9, 10 and 11). But the indicators required for articles 8, 9, 10 and 11 are only due on June 30, 2023.

In April of 2022 the European Commission adopted the final Regulatory Technical Standards. For a brief summary of all changes and some general guidelines to follow, please continue reading: Final SFDR RTS: European Commission adopts Regulatory Technical Standards under SFDR.

Take action

The SFDR Level 1 requirements were due on March 1, 2021. Be sure to comply with these policy statements. Don’t wait too long with taking up the Level 2 requirements though. It will take quite some effort to source, compute and publish these (PAI) data in the required formats. We recommend making smart decisions on your ESG data landscape in the second half of 2021.

We are always open for a chat and we encourage discussions, especially when it comes to financial market data. Let us know your challenges, questions and uncertainties relating to the Sustainable Finance Disclosure Regulation.