ESG Screening: Helping you meet every requirement

ESG considerations have never been more important. With rising demands from investors and regulators, financial institutions must screen their investment universe against the ESG factors that matter to stakeholders. Meeting these requirements comes with major data challenges.

3 Key benefits of the

BIQH ESG Screening

Flexible business rules let you tailor ESG evaluations to your organisation’s needs, ensuring the process aligns with your strategy and long-term goals.

Customizable business rulesApply ESG screening to externally managed portfolios, such as mutual funds and ETFs, reducing supply chain risks and ensuring partners meet your ESG standards.

Screening external portfoliosWant to know more?

Download the whitepaper on ESG Screening

Solving the ESG Screening Headache

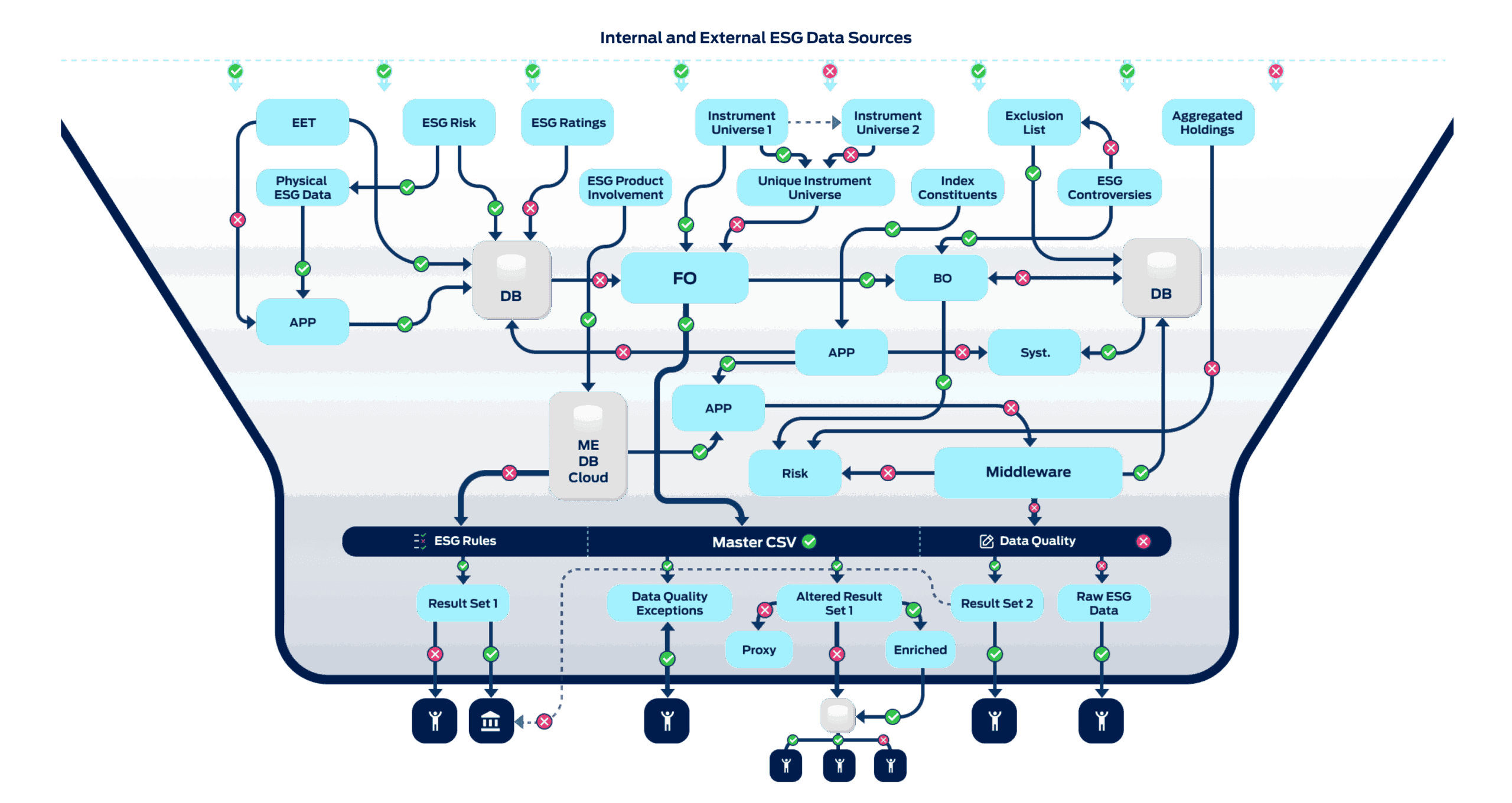

Consolidating ESG data is complex and prone to errors. The BIQH ESG Screening Platform tackles this by structuring and mapping all relevant inputs, from exclusion lists to ratings, into clear, reliable pass/no-pass results.

Validated by:

- Greater reliability and accuracy

- Reduced operational risk

- More efficient screening processes

General ESG Screening

challenges in the market

A tangled mix of data sources, interfaces and formats, often causing inefficiencies and errors.

Small issues in data consolidation can trigger major disruptions and increase risk.

Manual tasks and duplicated data raise operational costs and reduce efficiency.

Inconsistent data sources and formats make it difficult to maintain accuracy and comparability.

Constantly changing requirements demand adaptable, future-proof solutions.

How BIQH tackles ESG Screening challenges

We consolidate and unify data from multiple sources into a consistent structure, reducing complexity and improving integrity.

Automation removes the risk of single-point failures, making ESG screening more robust and dependable.

The platform delivers clear pass/no-pass results, reducing risk and enabling confident decisions.

Manual work and duplicated data are eliminated, cutting costs and boosting efficiency.

Our solution supports diverse formats and adapts easily to changing regulations.

Our latest insights

Read our latest articles about ESG

The challenge of physical risks: how it forms an important aspect of ESG data

At BIQH, we regularly write about ESG data, management, and screening. This topic is crucial to us and our clients. Today we focus on physical risks such as natural disasters…

The ESG screening headache: a Tier 1 bank example

Introduction At BIQH, we often see financial institutions struggling with their ESG screening process. These institutions face challenges ranging from integrating and mapping diverse data sources to ensuring compliance with…

FAQ on ESG Screening and ESG Data Management

Introduction Environmental, Social, and Governance (ESG) Screening is becoming increasingly important in the financial industry. Where financial institutions previously managed many processes manually, they are now focusing on switching to…

Get in touch with BIQH

Want to learn more about our ESG Screening solution? Book a demo, start small with our 3-step approach, or simply have a coffee chat with us online.

Market data consumers should be flexible in choosing whichever data source they wish to use.

Bernard Schut

Business Director

Our ESG screening combines internal and external sources into one structured model, mapping otherwise unrelated data to deliver accurate, actionable insights.

Comprehensive data integration