The importance of business rules in market data management

Business rules are a standard, essential part of market data platforms. In this blog, we will explain what makes them so beneficial, how they work, and how to apply business rules to processes like ESG screening. We’ll explore the importance of business rules in market data management and dive into their practical use cases.

Utilizing Business Rules

Unlike traditional systems restricted to applying rules only at the column level of a table, we let our customers apply rules at the more detailed cell level. Imagine being able to apply rules with precision, only where they’re needed. This level of detail gives you more refined control over your data, helping to make necessary adjustments accurately.

The most important applications of business rules are:

- Validations

- Alerts

- Calculations

- Classifications

- Identification of stale date

- Outliers identification and exception handling

Below, we will explore each of these applications in more detail.

Validations

Market identifiers like ISIN or CFI codes are essential for distinguishing between different financial instruments. These identifiers must comply with specific ISO standards, and business rules can be used to validate whether they meet these standards correctly. Additionally, technical validations can ensure that data fields conform to the expected data format, such as requiring a date, string, or integer.

Alerts for errors and warnings

Business rules can be set up to trigger alerts, such as errors or warnings, when data does not meet expected criteria. For example, this could be due to outlier identification (e.g. in terms of pricing data) or missing data. Depending on the type of trigger alert, users can set up business rules to import the data with a warning or reject it entirely if it fails to meet validation requirements. This approach helps users maintain high data quality by enabling early intervention and preventing potential issues from escalating.

Calculations with business rules

BIQH’s business rules support advanced calculations and derivations, allowing derived fields and statistics to be integrated easily. For example, calculating the mid-price as the average of bid and ask prices can be done seamlessly. This flexibility empowers users to define their own fields based on a tailored set of business rules. However, it is crucial to ensure that the data source grants explicit permission for such transformations to be applied to their proprietary data, maintaining compliance and respecting data usage policies.

Classifications with business rules

Another advantage of business rules is the ability to classify data automatically using case expressions. Case expressions are like decision-making tools for your data helping to apply conditional logic, allowing users to handle data differently based on specific conditions and return appropriate results. There are two main types of case expressions:

- Simple case expression: This compares a single value against multiple possible outcomes.

- Searched case expression: This evaluates multiple conditions using WHEN clauses to decide which condition applies.

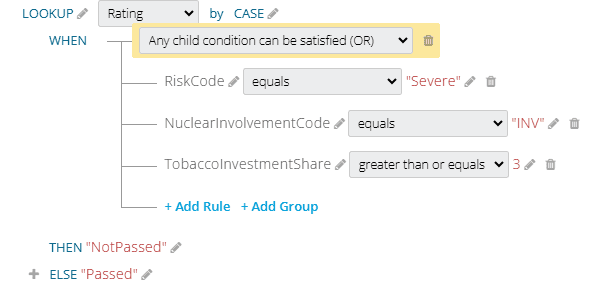

Consider an ESG Screening example where you need to determine whether data meets specific conditions (see Figure 1): if the risk code is ‘Severe,’ the nuclear involvement is ‘INV,’ or the tobacco investment share is greater than or equal to 3, the data is labeled as ‘NotPassed.’ Otherwise, it is classified as ‘Passed.’ This classification is a good example of how case expressions can be used for the ESG screening process, for example, by a bank.

Figure 1: Snippet from BIQH’s Business Rule Configurator

Want to know more about our ESG Screening use case? Download our ESG Screening factsheet

Identification of stale data

Have you ever wondered if all the data you store is actually useful? Stale data, meaning data that is not updating as expected, can be identified using business rules. For instance, if the delivery from your golden copy of a data point like the daily price of a key asset suddenly stops changing or remains the same for an extended period, this might indicate an issue that needs addressing, such as expired instruments, changed trading venues or data source problems. By recognizing these stale data points, companies can ensure timely data updates, maintain data accuracy, and intervene when needed, thereby preventing data inconsistencies and improving overall data reliability.

Outliers identification and exception handling

Outliers in data can indicate potential issues that need further investigation. For example, if a particular value deviates significantly from previous values or the expected range, it may be flagged for review. Business rules can help identify such outliers and determine appropriate actions. Users may choose to import the data with a warning, acknowledging the deviation, or they may reject it if the deviation suggests a critical issue. This flexibility ensures that data quality is maintained while providing the necessary notifications for unusual data patterns.

User-friendly settings for all users

Modern business rule configurators are designed with usability in mind. At BIQH, we have recently updated our business rules configurator to further enhance this usability. Anyone in your organization—from data analysts to compliance managers—can easily set up and adjust rules, provided they have the proper authorization. This means business rules can be used without requiring developers to write code.

Conclusion

Business rules are a key tool for effective market data management. They address the challenges of data consistency, compliance, and cost efficiency, making sure that market data is used to its fullest potential within your organization. The BIQH Market Data Platform makes it easy to set up and manage these business rules, enabling more accurate and efficient data usage.

Want to learn more about how BIQH can help optimize your market data management? Get in touch or download our factsheet.