The 5 pitfalls that derail business cases – and how to avoid them

Introduction: Buying a Market Data Platform? Start with a solid business case

Procuring a market data management (MDM) platform is not something to be taken lightly. It is often a cross departmental decision involving, among others, IT, finance, operations and compliance. While the goal of buying such a platform is often to untangle the market data spaghetti, building a strong business case can prove difficult. The current solution likely carries hidden costs, yet justifying change with data you do not have is a challenge. You need insight into your numbers to make your case, yet gaining those insights requires an MDM platform. It becomes a circular problem.

Perhaps you have already identified inefficiencies, such as manual validations that consume valuable time, fragmented vendor contracts or inconsistent symbology across teams. You recognise the potential value of a central, vendor independent platform. But how do you secure the buy in to move forward?

The answer lies in a solid, measurable and credible business case. One that goes beyond presenting a shiny new tool and instead demonstrates how market data flows will improve, how compliance risks will be reduced and how tangible operational costs can be lowered.

Let us explore the five common reasons why these business cases fail, and more importantly, how you can avoid those pitfalls.

Table of Contents

1. Why business cases fall apart

According to McKinsey, nearly 70 percent of large scale transformation efforts fail, even when supported by smart technology, good intentions and compelling presentations. In the financial sector, where data systems are becoming more complex and regulatory pressure is increasing, this trend often repeats itself.

These failures usually stem from three main causes: weak data foundations, poor alignment among key stakeholders and underestimated risks during implementation. For organisations managing multiple market data vendors and legacy systems, these challenges are especially significant. The good news? They can be avoided if you know what to look out for.

Insufficient data foundations

Many business cases remain vague and superficial. A common example is the promise of “more efficient data handling” without any attempt to quantify the benefits. What gets measured, gets managed. Imagine reducing manual validation of market data by 40 hours per week. That could translate into savings of €120,000 to €150,000 annually. Without concrete figures like these, your business case will struggle to gain traction.

Lack of stakeholder alignment

Even a well constructed proposal will not succeed if IT, compliance, data owners and business users are not aligned. In many firms, the data environment is fragmented, with each department maintaining its own version of the truth. The result is confusion, resistance and conflicting priorities. One way to address this is by establishing a cross-department steering committee early in the process, bringing together representatives from IT, compliance, business units and data governance.

Underestimated implementation risks

On paper, vendor transitions and new data flows may appear straightforward. In practice, they carry serious risks, such as reporting errors, compliance breaches or outages. Without thorough validation and clearly defined data standards, you risk costly rework. That is why it is essential to address these concerns before finalising your business case. Consider discussing the implementation approach with your potential MDM solution provider at an early stage.

2. Concrete and measurable results

A compelling business case turns ambition into clear outcomes, supported by meaningful metrics.1

SMART goals and KPIs

SMART goals (specific, measurable, achievable, relevant and time bound) help clarify what success looks like. For example:

“Within 90 days, 90 percent of pricing feeds should be validated through the central data pipeline, with automatic error notifications in place.”

Input versus outcome KPIs

It is important to track both what is being done (input KPIs) and what is being achieved (outcome KPIs). For example:

- Input KPI: “Implementation of the new BIQH Market Data Platform completed in Q2.”

- Outcome KPI: “An 80 percent reduction in data mismatches between front office and compliance systems.”

Using OKRs

Objectives and key results (OKRs) combine ambition with accountability. For example:

Objective: Improve the quality of client reporting data

Key results:

- 100 percent availability of pricing data

- Only one security master file

- 90 percent time reduction to solve data errors

These kinds of metrics make it easier to measure progress, demonstrate value and secure continued support.

3. Financial realism without rose tinted glasses

Overly optimistic financial assumptions or overlooked costs can quickly undermine trust in your business case.2

Hidden costs

Make sure to account for less obvious expenses, such as:

- Internal effort required from data owners, IT and business users

- Training costs for new tools or processes

- Temporary dual running of both legacy and new data feeds

- Adjustments needed in downstream systems (when needed)

Cash does not equal profit

Lower vendor invoices do not necessarily result in long term savings. You must look at the total cost of ownership and the long term value. For example:

- Will certain applications remain dependent on legacy data feeds, or on specific content that legacy vendors currently deliver?

- Does the new setup offer faster and more automated validation than your current environment?

Cost models that only focus on market data vendor spend often ignore ongoing manual work, integration rework or unexpected increases in license fees. Sustainable savings require a realistic, full lifecycle view.

4. Testing feasibility first

A strong business case includes time for practical validation before full approval.3

A 90 day proof of concept

Start with a focused use case, such as validating pricing data or centralising reference fields. A three-month pilot allows you to test data quality, system compatibility, user adoption and get familiar with the vendor’s way of working, a crucial step for long-term success.

Independent review

Have your business case reviewed by someone not directly involved in the project. This could be an internal stakeholder or an external expert. A second opinion helps identify blind spots and builds broader support.

Early user feedback

Involve key users early on, such as front office teams that rely on realtime snap data or compliance teams that depend on ESG classifications. Their insights are essential for achieving lasting adoption and smoother implementation.

5. Building on reliable data

No business case is convincing without a strong data foundation. Use a combination of internal evidence and external benchmarks to support your case4.

Internal data

Make use of incident logs, vendor contracts, query volumes and the time spent on manual checks or duplicate handling. These sources provide a clear picture of your current setup and reveal inefficiencies.

Peer benchmarking

Compare your situation with that of similar organisations. What do others pay for their MDM systems? How many vendor feeds do they manage? What are typical levels of data latency? Can the MDM provider share client examples or results that offer relevant insights? These types of benchmarks make your case more credible and grounded in actual market conditions.

Research and governance

Use findings from external research, audits or regulatory reports to strengthen your case. Integrate this into a clear data governance framework that outlines who uses which data, for what purpose and under what quality standards. This brings structure and transparency to your proposal and supports long term success.

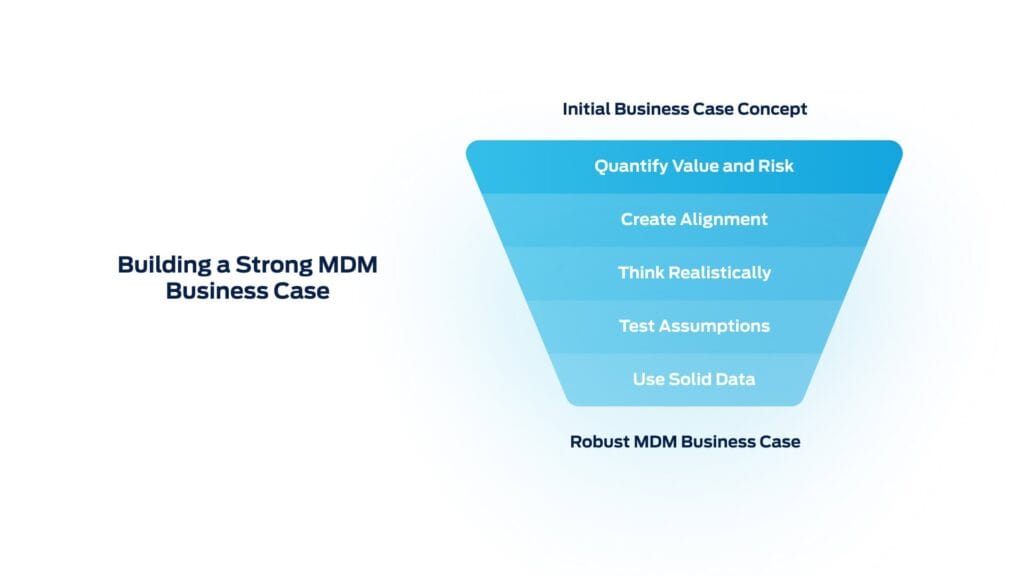

Recap: the 5-step checklist

A strong business case for a MDM-solution is not just a spreadsheet. It is a structured and strategic narrative, grounded in facts and clearly linked to business outcomes. To build a case that stands up to scrutiny, make sure you cover these five essentials:

- Quantify value and risk

Use concrete figures to demonstrate improvements in data quality, reductions in manual effort and opportunities to optimise vendor costs. - Create alignment

Involve business teams, IT, compliance and end users early in the process. Alignment across departments builds momentum and reduces resistance. - Think realistically

Acknowledge the migration effort, potential disruptions and the temporary need for parallel data feeds. Include all relevant costs, not just vendor fees. - Test assumptions early

Run a focused pilot, gather user feedback and ask for an independent review. This strengthens your case and helps surface potential blind spots. - Use solid data

Support your case with internal metrics, industry benchmarks and a clear data governance model. This ensures transparency, trust and long term value.

A business case should reflect your ideal data environment: well structured, transparent and easy to follow. Take the time to get it right. It will save you time, frustration and money later on.

And finally, do not hesitate to ask whether the party you are speaking with can help you build the case. This could be directly, or together with consultants who already know the product and understand the implementation challenges.

- https://hbr.org/2023/01/to-make-lasting-progress-on-dei-measure-outcomes ↩︎

- https://www.cfo.com/news/five-reasons-why-your-finance-transformation-failed/665594/ ↩︎

- https://hbr.org/2021/05/piloting-new-business-initiatives ↩︎

- https://www.forbes.com/sites/allbusiness/2014/08/09/5-important-steps-to-getting-your-business-case-approved/ ↩︎