From dependence to independence: the strategic power of switching identifiers

Everyone knows the problem of becoming dependent on others. You get stuck in a situation, and you lose your flexibility. One common example we see tied to market data is getting identifiers from specific market data vendors, resulting in dependency. In this blog, we’ll explain how this dependency gradually develops, what two possible solutions are, and most importantly, how you can eventually break free from it.

The problem: market data vendor identifiers

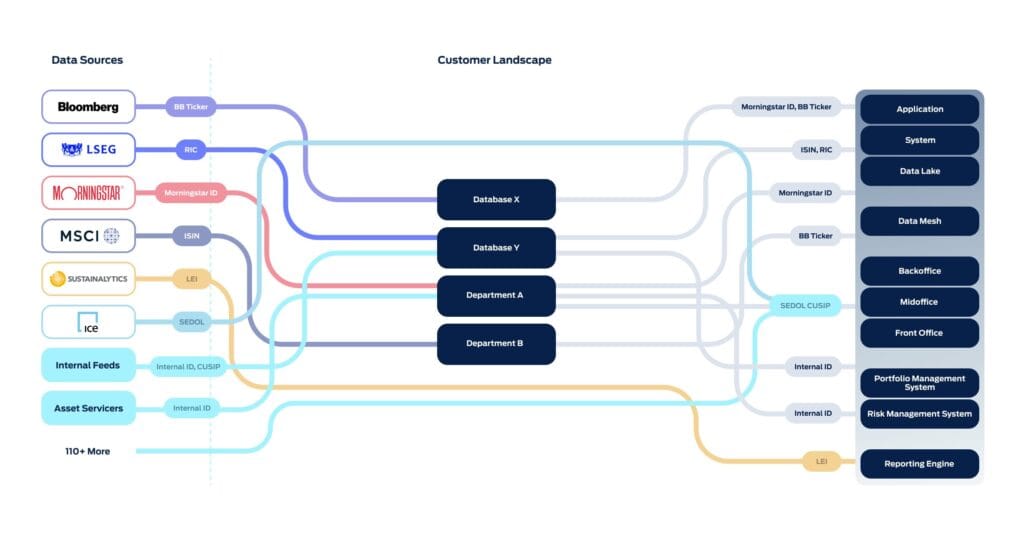

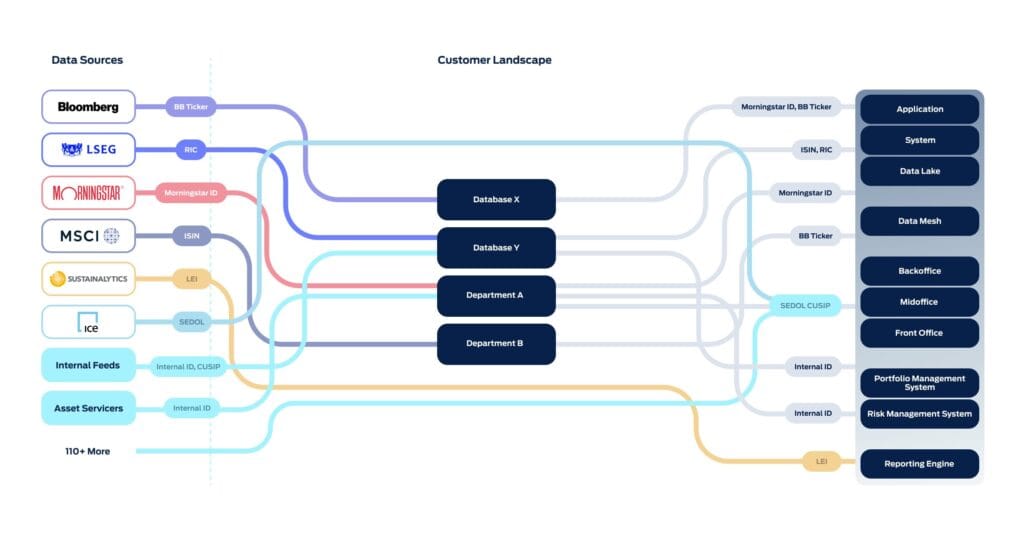

Imagine setting up your market data systems based on unique identifiers from a specific market data vendor. Everything runs smoothly until the market data becomes more expensive or the quality of delivered data comes into question. Suddenly, you realize you’re completely dependent, experiencing what we call vendor lock-in. Vendor-specific identifiers, for example, Bloomberg Tickers, Morningstar IDs or LSEG RIC codes, create this lock-in, making it difficult to switch vendors or change workflows without disruptions. This is often compounded by the complexities of downstream systems that rely heavily on these identifiers, as well as a lack of IT change capacity and market data expertise This dependency limits flexibility, which can increase costs, and prevents companies from optimizing their data to meet changing needs. Additionally, it restricts the ability to combine data from market data vendor A with market data vendor B.

Option 1: standard identifiers like ISIN and FIGI

The first option involves adopting standardized identifiers such as ISIN (International Securities Identification Number) or FIGI (Financial Instrument Global Identifier), introduced by Bloomberg. These identifiers are recognized across the market, making it easier to share data between systems. By using standards like ISIN and FIGI, companies create a common language for data, which reduces confusion, improves data quality, and facilitates seamless communication with other market participants.

ISINs are globally recognized and widely used in regulated financial markets, making them ideal for firms needing universal applicability. However, you have to pay to receive ISINs for American and Canadian entities because they are issued by CUSIP. For example, a Dutch company requires a CUSIP license to use U.S./CA ISINs in their products. For small companies, the CUSIP license may be free, but larger firms typically face costs, adding to the overall expenses. Of course, an ISIN by itself is not unique; it needs to be accompanied by a Currency and Market Identifier Code. For these, standardized ISO formats are in place (ISO 10383 and ISO 4217).

FIGI, in contrast, is an open standard available without licensing fees and helps uniquely identify financial instruments, similar to the LEI (Legal Entity Identifier). These standards can serve as a solution for companies seeking a more independent data strategy, without being tied to alternative vendor-specific identifiers.

Option 2: moving to own identifiers

Creating your own identifiers gives companies full control over their data infrastructure, eliminating reliance on vendors or standardized identifiers. For example, we see that core banking systems are generating internal identifiers on an instrument and/or listing level. These could be used. And of course, it is important to maintain these identifiers. Custom identifiers allow companies to manage data in a way that suits their unique needs, integrate data from various sources effectively, and quickly adapt to regulatory or market changes. This significantly reduces lock-in risks and ensures companies can operate their data processes independently, without external constraints. We advise our customers to not use BIQH identifiers (although we do have them). You don’t want to shift the vendor dependency to BIQH after reducing dependency on data vendors.

Benefits of switching identifiers

Switching identifiers, whether to standardized identifiers like ISIN or FIGI, or to custom own identifiers, offers several key benefits:

- Greater flexibility for integrating data and adapting to changing business needs.

- Better control over data management processes, providing more independence and reducing risks of vendor lock-in, potentially leading to lower costs.

- Enhanced data consistency by implementing a unified identifier strategy.

- Improved scalability of data systems, allowing easier adaptation to future changes.

How to make the switch

Switching to new identifiers, whether to standardized options like ISIN or FIGI, or to custom identifiers, requires a careful approach. The process begins with assessing current data systems to identify where vendor-specific identifiers are used. From there, companies can develop a phased plan to gradually replace these identifiers, either by adopting standardized identifiers first or moving directly to custom identifiers.

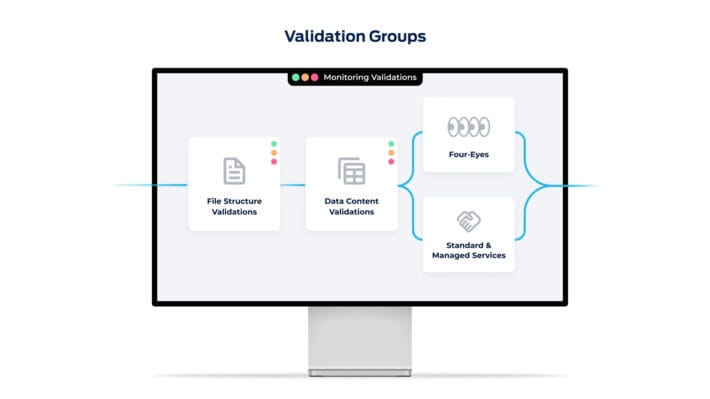

However, switching identifiers is not without challenges. Companies often face technical obstacles, such as the need to modify or upgrade legacy systems that may not support new identifiers. Costs can also be significant, especially when integrating new technology or employing external expertise. Additionally, the transition process can be time-consuming, requiring careful planning to prevent operational disruptions. Making the switch requires RecordLinking. RecordLinking is difficult, and therefore it is often necessary to involve specialists like BIQH.

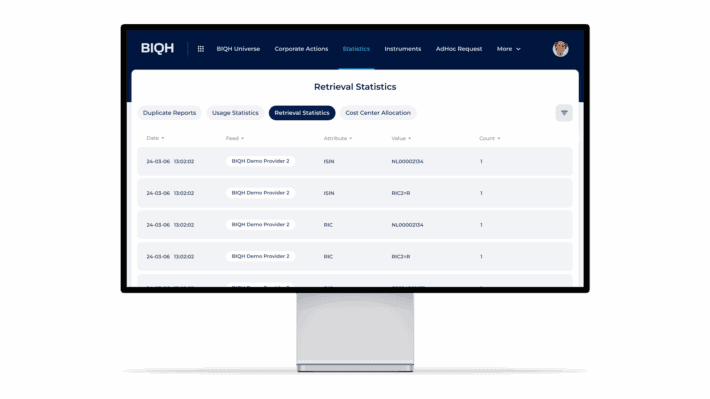

Despite these challenges, the benefits are clear, but the route to achieve them can be a significant hurdle. Fortunately, from our experience, we know that this does not have to be one massive project. It can be broken down into smaller steps or projects, allowing firms to gradually and efficiently elevate their market data management to the next level. Modern market data systems can also help facilitate the switch by making it possible to quickly map identifiers between different sources, often in an automated manner, thereby serving as a linking pin within the organization.

Conclusion

Switching identifiers is a crucial step for companies aiming to reduce vendor dependence and gain greater control over their data management. Whether adopting standardized options like ISIN or FIGI, or moving to custom identifiers, each approach offers distinct advantages. By carefully planning the transition and breaking it into manageable phases, companies can overcome the challenges involved. With the right strategy and support, firms can elevate their market data management and position themselves for long-term success. Modern market data, like BIQH, systems can hereby function as a linking pin. So, despite the hurdles, you can take small steps and kickstart the journey to independence.

Want to know more about how BIQH is handling the spaghetti of symbology? Download our factsheet or reach out.