Sustainable Finance Disclosure Regulation: Is the SFDR postponed?

In this article we want to explain you a little bit more about the question whether the SFDR is postponed, or not.

Recently the European Commission has sent a letter to the ESA’s about the delay of the Regulatory Technical Standards [RTS] which is considered Level 2 of the Sustainable Finance Disclosure Regulation [SFDR]. But does this mean the SFDR is postponed?

As the European Commission states in their letter “The unprecedented economic and market stress caused by the Covid-19 crisis has necessitated an extension of the deadline for the public consultation on the draft regulatory technical standards.”.

The RTS will provide detailed requirements on the content and presentation of information. In addition, the RTS will also standardize methodologies, for example on the calculation of the different indicators which are part of the Adverse Sustainability Impact Statement for Financial Market Participants [FMP’s].

The letter is quite clear that although the Level 2 RTS will be delayed the effective date of SFDR will remain to be March 10, 2021 for the Level 1 text of the regulation: “Therefore, all application dates are being maintained as laid down by the Regulation with effect from 2021 so financial market participants and financial advisers subject to the Regulation will need to comply with its high level and principle based requirements from that time”. The final RTS is to be expected in the course of 2021.

SFDR postponed? What are the implications?

As we see it, the postponement of the Level 2 RTS gives only little room to breathe but nothing more than that. FMP’s and FA’s which are subject to this regulation will need to include additional information and explanations in various disclosures like pre-contractual and periodic disclosures. The effective date to comply with these provision from SFDR will remain to be March 10, 2021.

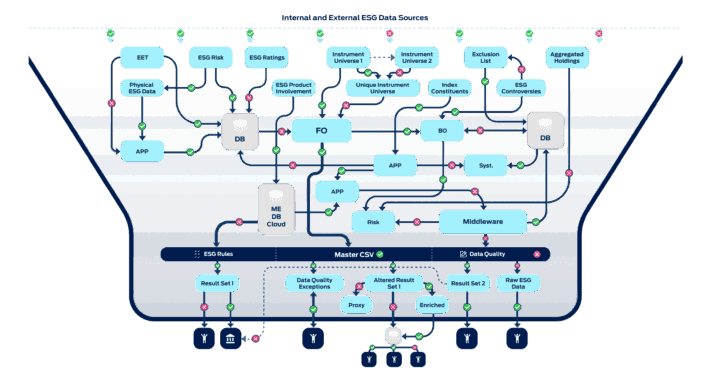

When the Level 2 RTS is published in the course of 2021, FMP’s and FA’s will have to ensure that they have already made the necessary arrangements in order to take in and aggregate the necessary data from internal and external sources, make complex calculations to report on a broad range of indicators and they’ll need to have a solution to publish the information (multi-lingual in most cases) in different (legal) documents and on their website.

What do you need to do before March 10, 2021

FMP’s and Financial Advisers [FA’s] will need to comply as of March 10, 2021 with the disclosure obligations that do not rely on the Level 2 RTS and they even need to comply with those obligations that partially rely on the Level 2 RTS.

More specifically:

- Article 3 of SFDR requires:

- FMP’s need to publish information about their policies on the integration of sustainability risks in their investment decision‐making process.

- FA’s need to publish information about their policies on the integration of sustainability risks in their investment advice or insurance advice.

- Article 4 of SFDR requires FMP’s and FA’s to publish the Adverse Sustainability Impact Statement on their website. Especially for FMP’s, this disclosure obligation relies heavily on the Level 2 RTS. Nonetheless the compliance date for the provisions that don’t rely on the RTS in this article remain March 10, 2021 and will require FMP’s to disclose information on on their due diligence policies with respect to the principal adverse impacts of investment decisions on sustainability factors.

- Article 5 of SFDR requires FMP’s and FA’s to include in their remuneration policies information on how those policies are consistent with the integration of sustainability risks.

- Article 6 of SFDR requires FMP’s and FA’s to include the following information in so-called pre-contractual disclosures. For example, a UCITS management company needs to include this information in the prospectus. A full list of where this information needs to de disclosed per type of FMP or FA can be found in article 6 (3) of the regulation.

- FMP’s need to include information on the manner in which sustainability risks are integrated into their investment decisions.

- FMP’s need to include information about the results of the assessment of the likely impacts of sustainability risks on the returns of the financial products they make available.

- FA’s need to include information on the manner in which sustainability risks are integrated into their investment or insurance advice.

- FA’s need to include information on the result of the assessment of the likely impacts of sustainability risks on the returns of the financial products they advise on.

- Article 8 relies partially on the Level 2 RTS. Nonetheless it requires issuers of a financial product that promotes environmental and or social characteristics to include information on:

- How those characteristics are met.

- If an index has been designated as a reference benchmark, information on whether and how this index is consistent with those characteristics.

- Article 9 relies partially on the Level 2 RTS. Nonetheless, it requires issuers of a financial product that has sustainable investment as its investment objective to include information on:

- How the designated index (the benchmark) is aligned with that objective.

- Why and how the designated index (the benchmark) is aligned with that objective differs from a broad market index.

- Where information can be found on the methodology used for the calculation of the benchmark.

- If there is no benchmark assigned, an explanation should be given on how that objective is to be attained.

- If the financial product has a reduction in carbon emissions as its objective, the issuer of that product should include information in pre-contractual disclosures (see also the information at the bullet regarding Article 6 above) on that objective and how it’s aligned with achieving the long‐ term global warming objectives of the Paris Agreement.

- Article 10 relies partially on the Level 2 RTS. Nonetheless it requires both issuers of a financial product that promotes environmental and or social characteristics and issuers of a financial product that has sustainable investment as its investment objective to describe and publish on their website:

- The environmental or social characteristics or the sustainable investment objective.

- The methodologies used to assess, measure and monitor the environmental or social characteristics or the impact of the sustainable investments selected for the financial product, including its data sources.

- Article 11 relies partially on the Level 2 RTS. Nonetheless it requires both issuers of a financial product that promotes environmental and or social characteristics and issuers of a financial product that has sustainable investment as its investment objective to describe in periodic reports. A full list of where this information needs to de disclosed per type of FMP or FA can be found in Article 11 (2) of the regulation.

- For “Article 8 products” to include information on the extent to which environmental or social characteristics are met.

- For “Article 9 products” to include information on the overall sustainability‐related impact of the financial product by means of relevant sustainability indicators. It must be noted here that the sustainability indicators from which the issuer of the financial product can choose from are to be derived from the Level 2 RTS.

- For “Article 9 products” which have a designated benchmark, the issuer has to include comparison between the overall sustainability‐ related impact of the financial product with the impacts of the designated index and of a broad market index through sustainability indicators. Again, the the sustainability indicators from which the issuer of the financial product can choose from are to be derived from the Level 2 RTS.

To conclude

We’ll continue to monitor and inform you about relevant news and updates on the SFDR regulation and the Level 2 RTS. To stay up to date, please subscribe to our regular blog updates on the right side of this blog post.

Please let us know your questions, comments and concerns about SFDR and reach out to me via LinkedIn or send me an e-mail at colin.prins@biqh.com.