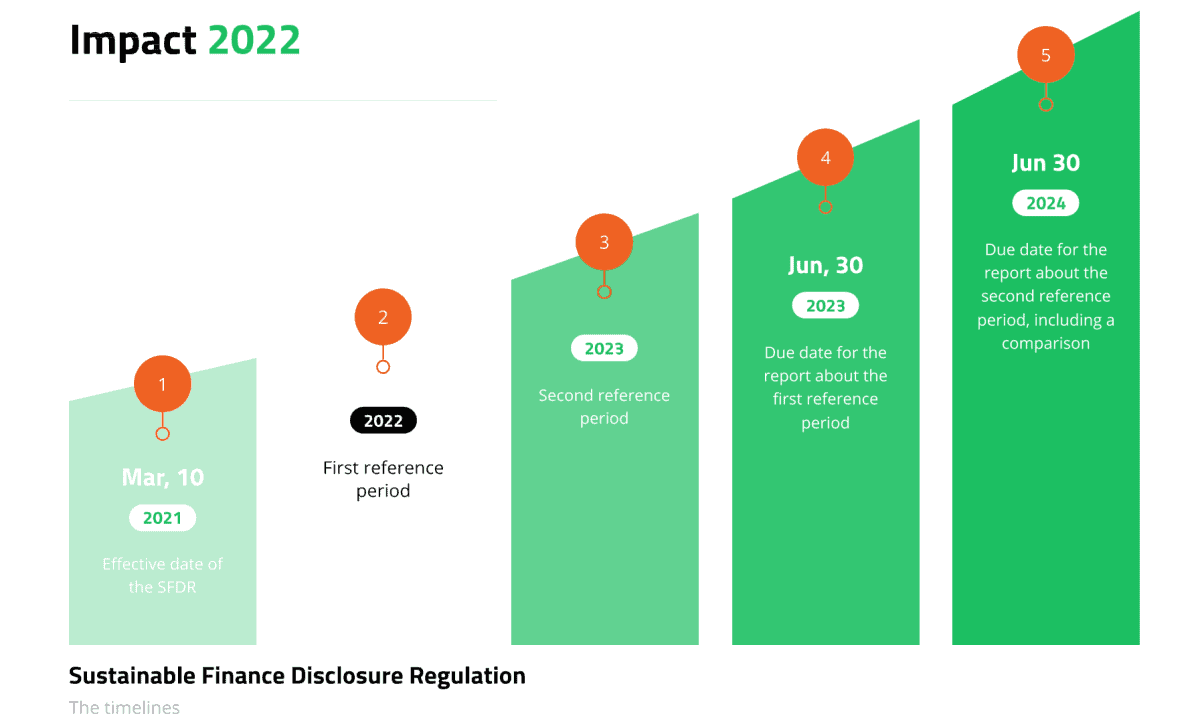

Sustainable Finance Disclosure Regulation [SFDR]: SFDR Timelines

![Sustainable Finance Disclosure Regulation [SFDR]: Timelines and progress of implementation](https://www.biqh.com/wp-content/uploads/2020/11/pexels-scott-webb-305833-scaled-1-1024x683.jpg)

As of March 2021 the new Sustainable Finance Disclosure Regulation [SFDR] came into effect. This regulation is developed to drive sustainable investment. The SFDR will have big impact on asset managers, banks and fund brokers. We offer you a complete blog series focusing on the SFDR, the obligations, the definitions, the indicators and the Adverse Sustainable Impacts Statement to help you get your head around the subject. In our blog posts we focus on the impact of this regulation to you as a Financial Market Participant to ensure you are well prepared for the new regulation.

In this article we will focus on the timelines and the progress of the implementation. What important dates do you need to put in your calendar?

This blog post was first published on October 21, 2020 and updated on August 25, 2021.

SFDR: What has happened and has been done until now?

In the past years the awareness for sustainable business has grown, leading directly to new initiatives and regulations. We clearly see a shift from a more generic approach to more specific directives and regulations. SFDR is by far the most impactful measure. What steps have been taken so far?

- October 22, 2014: The EU has adopted directive 2014/95 (the NFRD) which imposes requirements to (large) companies and organizations to disclose information and report on non-financials such as social and environmental aspects;

- December 12, 2015: Paris Agreement on climate change was signed;

- March 8, 2018: The European Commission has released their action plan on Financing Sustainable Growth;

- November 27, 2019: The EU has adopted regulation 2019/2088 (the SFDR) and 2019/2089 (the Benchmark Regulation);

- June 18, 2020: The EU has adopted the Taxonomy Regulation 2020/852 which amends (parts of) the SFDR regulation; and

- February 4, 2021: The ESAs publish the final report and draft RTS on disclosures under SFDR.

- February 25, 2021: The ESAs publish a joint supervisory statement with an overview of the application dates of the different SFDR and TR disclosure obligations

- April 21, 2021: The Commission has adopted a proposal for directive COM/2021/189 final (the CSRD), which amends the NFRD to align with the European Green Deal. More specific this Directive aligns corporate sustainability reporting with the SFDR and the Taxonomy Regulation.

- July 9, 2021: The European Commission asks the European Parliament for delay of the application of the SFDR Level 2 RTS until 1 July 2022. The plan is to bundle all RTSs in a single delegated act to be published at the end of 2021.

SFDR: What is currently going on and what to expect?

The SFDR will become effective in March 2021, but includes many more important dates. To help you get your priorities right we made a timeline with all the important dates.

SFDR: The adverse sustainability impacts statement (entity level)

We’ve put all important dates in one comprehensible infographic. Herewith we assume that the draft RTS as presented in February 2021 by the ESAs will be adopted as the final RTS.

- March 10, 2021: Effective date of the SFDR regulation. Financial Market Participants [FMPs] can start considering principal adverse impacts.

- April, 2022: European Commission adopted the final version of the Regulatory Technical Standards.

- July 1, 2022: First reference period starts in relation to the indicators of various disclosures, whereas the Adverse Sustainability Impacts Statement.

- December 31, 2022: First reference period ends.

- January 1, 2023: Second reference period starts.

- June 30, 2023: The final date on which FMPs need to report for the first time, through the Adverse Sustainability Impacts Statement and other forms of disclosures under SFDR, their performance on entity level on various ESG indicators accompanied with textual explanations and commentaries.

- December 31, 2023: Second reference period ends.

- June 30, 2024: The final date by which FMPs need to report for the second time. In addition from this moment onwards they’ll need to make a comparison between the first and second reference period.

SFDR: Disclosure obligations on product level

In the above timelines we’ve focused on the Adverse Sustainability Impacts Statement. This disclosure on entity level needs to be published by FMPs with more than 500 employees on group level or when considering adverse sustainability impacts in their investment decisions and/or advice. Under SFDR, FMPs also need to disclose information in pre-contractual disclosures (for example via a prospectus document) and in periodic reports (for example via the annual report). Templates for these disclosures are provided in the final report of the ESAs which includes the draft RTS. Annexes II and III provide a template for pre-contractual disclosure for article 8 and 9 products. Annexes IV and V provide a template to disclose information in periodic reports for article 8 and 9 products.

FMPs, or better said, producers of financial products that are described under article 8(1), 9(1), 9(2) and/or 9(3) of the SFDR regulation, will need to report via various means to their clients on the sustainability impacts related to the financial product.

Article 8(1) products: Financial products that are promoting environmental or social characteristics Article 9(1), 9(2) and/or 9(3) products: Financial products with a sustainable investment objective Financial products covered under this regulation: - portfolio management; - an alternative investment fund (AIF); - an IBIP; - a pension product; - a pension scheme; - a UCITS; or - a PEPP.

Product level disclosure obligations

The ESAs have provided, through their final report and draft RTS a set of templates to disclose information under SFDR. On the product level the following disclosure obligations can be distinguished:

- Pre-contractual disclosure for financial products: templates are provided in Annexes II and III in the final report of the ESAs and the draft RTS. Article 6(3) of the regulation provides a list, per type of FMP, in which type of pre-contractual disclosure an FMP needs to disclose information. In addition, the Taxonomy Regulation will impose additional pre-contractual disclosure obligations.

- Product website disclosure: the final report and draft RTS provides details on the content and the presentation of information on product level on the website of the FMPs. These disclosures must be published in a separate section ‘Sustainability-related disclosures’ in the same part of the FMPs website where other information relating to the financial product is published.

- Product disclosure in periodic reports: templates are provided in Annexes IV and V in the final report of the ESAs and the draft RTS. Article 11(2) of the regulation provides a list, per type of FMP, in which type of periodic report an FMP needs to disclose information. In addition, the Taxonomy Regulation will impose additional obligations relating to disclosing information in periodic reports.

We are always open for a chat and we encourage discussions, especially when it comes to financial market data. Let us know your challenges, questions and uncertainties relating to the Sustainable Finance Disclosure Regulation.